Radio is dying. I get that. So do you. But where from here? At Convergence, I started talking to a radio lifer out by the pool, and he said something that stopped me in my tracks.- Well, I’ve been coming to this conference for 14 years and...

Wait a second, I said, you mean that for 14 years you guys have been meeting to try to figure out the next step in radio?

Oh, longer than that. I came along 14 years ago. No one’s really figured it out yet, except maybe the guys at Pandora, and the jury’s still out if they’re even making money either.

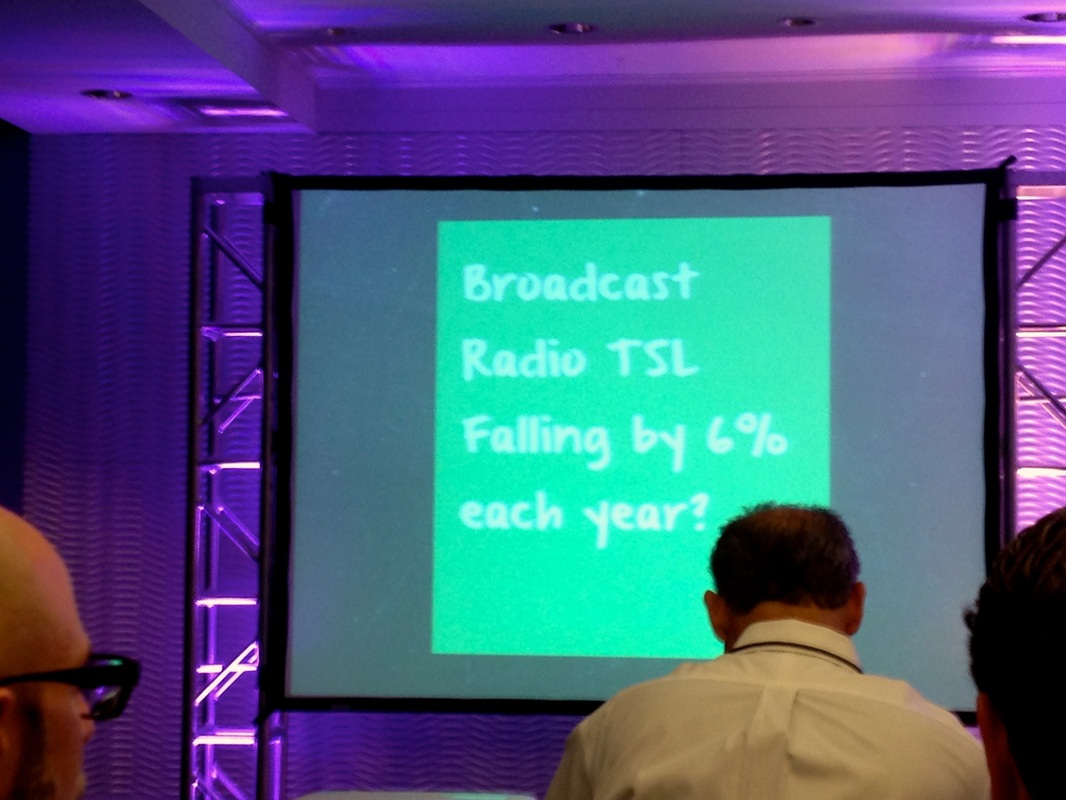

Yikes. Do you see what’s happening? My family and I have put all that we have into an industry that is shrinking by six percent a year, more or less. And the shrinking has been going on for a while.

This isn’t the first time we’ve been in this position. If you follow the show at all, then you know that for 18 years I traded in the pits of the Chicago Board of Trade. For the first dozen years or so, the Board of Trade was the shit… then computer trading slowly started taking over at, say, about six percent a year.

At first I tried to evolve along with the evolution. I bought rooms full of computers, hired people to trade on the computers, during the day and overnight. Spent tons of money and time. But in the end, I wasn’t the person to hook onto the technology train and go for a ride. First, my heart just wasn’t into it. And secondly, there just wasn’t the opportunity yet. All the pit guys I traded with who were trying to make it anew in a world of computer gaming-like trade struggled. It was a mass exodus from the pits to the computer… except that the guys who traded in the pits weren’t welcome in the new world.

I could, and probably should at some point, write a lot about the fall of pit trading. But for now, let’s talk about just a few of the lessons learned from that experience.

- Don’t spend too much money. I spent a ton of dough trying to get a jump on the new world of trading. Like every other pit trader, I was panicked, deer in the headlights. What was once a great way of life in which you could make good money was evaporating. What should I do? So I and many others did what we always did – threw money at the problem. It was the pit trader way and I had the dough to do it. Only after a while that started to dry up, too. Oh well, lesson learned. IN THE TRANSITION, DON’T SPEND TOO MUCH MONEY.

- Make sure your heart is in it. Because when it was all said and done, my heart was not into computer trading. I could hear the whispers, the voice from nowhere saying – what the hell are you doing? You hate sitting in this room of computers and screens and mice and printers and a view of LaSalle Street. GTFO now…. But I didn’t listen. For a good five years I traded in the pits in the day and spent the afternoons with my roomful of traders, even putting some in my home overnight next to the pool table. I put a bunch of traders in an office in Hammond, Indiana even. Some of it worked for a while, but really I simply made money trading in the pits like I always had and then subsidized the computer trading movement with that. After a while, I just realized that I like to trade in a pit and not in a room. I needed a high ceiling. A really high ceiling.

- Dedicate to the computer trading… or get out. The guys who made it as computer traders first had to say goodbye to being a pit trader. No shit. I won’t say his name, but the big kahuna in the five year pit just up and left one day. “You should leave, too, Jimmy. It’ll take a while, but eventually you’ll kill em on the computer.” The kahuna said that on his way out of the building on his last day. Instead, I took his spot in the pit and did my best impression of trying to be a kahuna myself. I suppose it worked some, but then again the walls of Rome were crumbling all around. The people like me who stayed and tried to burn the candle at both ends by trading in the pits and trading on the computer, in the end, didn’t rebuild. We’re almost all gone. Many of us broke, divorced, dead. The kahuna rebuilt, has a hedge fund.

The answer is: not very well.

1. Look at the first lesson – don’t spend a ton of money on new technologies. "If you build it, they will come" doesn’t work in this scenario, at least not when you’re whittling down your warchest with too many failed experiments.

I’ll spare you the details of my many failed trading experiments and just tell you about one of my many failed radio experiments.

Totally ignoring the lessons of the past, I sunk a ton of money into streaming video. In 2010, we put a videocam in the radio studio so that we could see where the jocks put the dials and could troubleshoot from home. That worked. We didn’t always have to drive down to the studio when an inexperienced host had issues… but on a whim we also put the stream up on the website and a bunch of people started watching it.

So to handle the 30 or 40 people or so who would watch it in a day, we started using livestream to send out the video. We started using the free version, but that was a crappy bitrate and they smothered our stream with ads, so in 2011, we switched to their pay version. If I remember correctly, it was about $1400 a month.

That worked OK, but we started getting antsy about paying that kind of money for no return on the video. Still, after all the upgrades to our stream – extra camera views, higher quality from better bitrates, lighting, etc. – we still weren’t getting that many more people who wanted to sit and watch a radio show.

So we did what all traders do – even one who has already learned his lesson – I threw a ton more money at it. For some reason, we thought, hey – why don’t we build our own proprietary streaming system and we can become the company that streams all the radio stations in America.

So we built out own proprietary streaming system including servers, redundant servers, wickedly expensive software, a ton of internet at two grand a month, etc. By the end of 2012, we had six figures into the project easy… and still, because of the limits of the bandwidth we could afford, we could only handle about 100 viewers at a time.

That’s hardly enough to handle our own needs during, say, a well-known guest interview or a high school basketball game. Let alone trying to become the company that could stream video for all radio stations in America because, you know, we know radio and we’re the first in the water about streaming video for radio.

We even spent a bunch developing our own dedicated app in which you could with one click be watching me talk on the radio or watch a high school game. We streamed for a few other people even, but in the end we were strapped by the amount of bandwidth we could afford. We would stream, say, a women’s professional football game, and as soon as it got around the internet that we were streaming it, we would crash at about 250 viewers. Life sucks then you die.

The whole video streaming thing has been a debacle, I suppose, except that I have learned a pretty valuable lesson all over again. If you think about it, I pretty much did the same thing I did in trading – throw a bunch of money at something when you really don’t know what you’re doing. Enough?

2. Look at the second lesson – make sure your heart is in it. In the end, I was a good pit trader and I liked pushing and shoving and screaming and writing my trades down on cards and then drinking and doing other stuff and then going home to my pretty wife. It’s a pretty good job and a pretty good life.

Then the computer monster changed all that. It was intense staring at a computer screen and then going home to hugging my wife and kids and then intense staring at a computer screen at home. And it was supervising a bunch of guys and gals who knew even less about trading on a computer than I did. I knew that there would be a ton of money to be made in the transition from pit to computer trading and I wanted to be one of the chosen who made a ton of money.

The only thing is – I freaking hate trading on a computer. And I don’t know enough about it to build a cool technology that a bunch of traders want to use or to teach newbies how to trade on a computer. So in the end, my heart wasn’t into it. I left and bought a radio station.

And ten years into radio, I’ve made the same mistake. I have put a ton of dough in an area where my heart’s not really into it. I don’t want to be an internet savant developing the golden egg that all of the guys and gals have been looking for at Radio Convergence for more than 14 years. I’m not that guy. It took me ten years of radio, and hundreds of thousands of investment, to figure that out. My heart’s just not that into video streaming and all that goes into it.

So where is my heart? I figure that I have crossover in two areas. Crossover to me is something that you like to do and you’re good at it.

First, I love to do radio. I don’t know why. When we bought the radio station in 2004, we never figured that I would be on the radio. Alexis and I actually bought the 85,000 circulation weekly newspaper near the same time that we bought the local radio station and I ran the paper. (Which was, of course, in another six percent declining industry. That’s its own book one day, by the way).

I ran the newspaper as publisher for almost three years, and then one day just closed it. Best business decision I ever made. I’m sorry, but I love each and every one of you in this room, but today will be our last issue of The Calumet Press. I’m sorry.

From that day, newspapers plunged. I could sense it, I guess, having dealt with the dying of pit trading, so I cut the losses now, so to speak.

Anyways, back to where my heart is. On the radio side, which my wife was running, we could never find the right host for the morning. It’s a really small peg to fit into. You gotta know the local area, be a little funny, know technical stuff about doing a radio show, and you gotta want to do it.

I had most of the qualifications, I suppose, except that you gotta want to do a radio show didn’t really apply. We didn’t buy WJOB so I could do a radio show. It was never even thought of. But one day in September of 2007 I told everyone on the radio side to GTFO of the building and I went in and did the morning show. And that has made all the difference. A couple days into it I knew that I had found a home.

So there. My heart is into doing live radio. Where else? Is my heart into developing scaleable ideas to save radio? Probably not. I get the sense that I have crossover in another area. And that is venture capital itself, the theory behind it, the taking of great ideas and bringing them to market. Making the world a better place and, because we can build a venture capital industry in northwest Indiana, making my home a better place with high paying jobs and, don’t get ahead of yourself, hope.

I attended Jerry Rosen’s weeklong venture capital course at my alma mater – UC Berkeley – and I’ve gotten involved with a few people also keen on the promise of venture capital for our home. I’ve attended the Innovation Conference in Indy, mentored at the Tech Foundry with Kelly Schwedland in Valpo, brought Rutkowski’s “Business Rockstars” to the WJOB lineup (and that two-hour show daily is all about high-tech entrepreneurship).

And we’ve moved WJOB into the Purdue Commercialization Center, where the university’s investing millions to basically start an entrepreneurship industry in northwest Indiana.

And I love every bit of the entrepreneurship push. I’ve got a steady stream of students taking classes in our space and eager interns who will work for nothing or next to it to learn our radio and our technology. It’s exciting and I love it.

But do I want to be the one to develop cool new technologies that will change the radio world and finally give the attendees of Radio Convergence 2016 something that will let them, as old world radio guys, make a ton of money?

Nah. I'm not so sure my heart was ever really into that part of venture capital. I could try for the rest of my life and not come up with a unique, scaleable technology. I do, however, sense crossover (talent and heart) in the venture capital area of bringing along new technologies and, yes, investing in them. Discovering, mentoring, investing and ultimately building an entirely new industry for this old industrial area - a venture capital cluster.

So there. In the quiet of a Sunday morning, with the dog snoring at my feet and the wife finally waking up to make some green peppers, tomatoes, onions and eggs. And, of course, jalapenos, cilantro and other spices in the mix also. In this quiet, as you forced me to answer – where IS your heart, JED? – I can, with as much honesty as a former pit trader turned radio host can muster, answer it like this:

I like to do radio and I'm starting to like to invest in new technologies. I’m good at one and learning about the other. That’s where my heart is. How does that sound?

3. What was the third lesson learned from the decline of pit trading and the debacle that followed it? Oh yeah – dedicate to the computer trading. Hmm. What does that mean? Should I quit doing my show on traditional AM radio and take it entirely to the internet? Should I quit doing radio altogether and dedicate to venture capital?

That’s too much for a Sunday morning. Learned a lot this week. With one hot topic (regretfully, a stabbing) I could increase my podcast downloads from 31 to 7,000 in one day (jimdedelow.podbean.com). But that’s not it. At some point, I will have to make decisions such as – do the show internet only? Or dedicate to venture capital and not do radio much at all?

Yes, to mix several metaphors, I hear those decisions on the horizon. But right now, for the most part, I have crossover where I’m at. I enjoy doing a radio show (and I'm decent at it) in my hometown a couple miles from my house. I ride my bike there. I have the most colorful callers and guests in the whole freaking world, and a lotta weirdly loyal sponsors. Every morning is a mystery and laughs and tears and hugs and news. It’s real.

And I'm starting to build some crossover (talent and heart) in venture capital too. Purdue is making an investment in the future and I’m literally in the middle of it. We’re building our more permanent studio in the first quarter of 2015 right in the middle of a huge entrepreneurship center, and we have all this eager, incredibly qualified talent around us. Sure, I will have decisions to make about where to point my efforts, but for now, a few days before Christmas, I’m exhausted like always and overweight like always and there’s certainly not enough dough around to do all the things I’d like to do, accomplish. But for the most part, I am grateful that I can do things like finally stop talking to you to eat some eggs way too spicy for my hairy white fish belly.

RSS Feed

RSS Feed